Nowadays, there is a continuous debate about the optimal long-term strategy for feeding the expanding global population and its consequences for research and development.

Some advocate for an evergreen revolution to ensure the supply of staple food, whilst others give prominence to enhancing and diversifying people’s diet. We aim to add to this debate by examining the case of wheat products and their impact on livelihood.

Agriculture is the cornerstone of India’s employing about 43 percent of the total human resources and contributing around 17 percent to India’s economy (Gross Value Added at current prices, 2019).

More than 70% of rural households in India rely on agriculture as their primary source of income. Agriculture and allied sectors are the greatest sources of livelihood.

About 82% of these farmers are small and marginal farmers (owning less than two hectares of land). According to the preliminary national income figures published by the CSO on May 29th May, 2020, the share of the agriculture and allied sectors in GVA of the country at recent prices is 17. 8% for 2019-20.

These facts prove that India is undoubtedly known as the "country of farmers. " Cereal processing industry is described as any industry that utilizes cereal or cereal products as a raw material.

The present production of wheat reached 108. 75 million tonnes with an average national productivity of 3424kg/ha. Wheat processing industry is a multibillion dollar market. It is one of the prime sources of nutrients for humans and animals.

The key characteristics that have made wheat the most frequently utilized crop in food processing are its wide adaptation to various agro-ecological situations, its storability, and its complex chemical composition, hence wheat is second important cereal crop in the world.

Triticum aestivum, Triticum durum, Triticum dicoccum are the three main wheat species cultivated in India. Due to substantial difference in grain quality amongst these species, several end products are produced.

Wheat is used as the primary ingredient in many bakery and home food products, Other consumer items, such as cleaning agents, skin care products, and hair products, as well as industrial uses (e. g. , renewable fuels) .

In India, the bulk of the wheat produced is processed into whole wheat flour for use in a variety of traditional food products, in contrast to developed nations. The roller flour mill processes around 10% of the entire wheat crop, which serves as the primary raw material for the pasta and baking industries.

The milling and baking industries continue to be the largest organized food industries in the nation despite the limited amounts of wheat that are processed in a roller flour mill for use in baked goods.

Table1 : Wheat processed products

|

SPECIES |

PRODUCTS |

|

Triticum aestivum |

Chapati, biscuit, bread, bun, cake & pastry, noodles, snacks (samosa, matthi, kachori), sweets(ghewar, balushahi), pizza, puri, kulcha,etc |

|

Triticum durum |

Pasta, vermicelli, semolina,etc |

|

Triticum dicoccum |

Pan cake, flour, pasta,etc |

The baking business has grown significantly over the past two decades as a result of the population boom, increasing foreign influence, the expansion of the female workforce, and shifting dietary preferences.

One of the largest sectors of the nation's processed food industry is the baking sector. Over 82% of all bakery items in the nation are bakery items, with bread and biscuits comprise the majority. Being the third-largest producer of biscuits, India's bakery industry has a competitive edge in production because of the country's plentiful availability of essential ingredients (after the United States and China).

The heart of the Indian baking industry lies in Maharashtra, Andhra Pradesh, Karnataka and Uttar Pradesh. The unorganized sector accounts for around 60% of production, with the organized sector producing the remaining 40%. About 2 million unorganized bakeries, including cottage, entrepreneurs, and small bakery units, are in operation.

Compared to western nations, where the average person consumes 50–100 kg of bread each year, the country's per capita consumption of bakery goods is just approximately 2 kg. Large, medium, and small-scale firms that make bread and biscuits make up the organized sector. Bread and biscuit production are high-volume, low-margin industries.

Additionally, a little over 40% of bread and 50% of biscuits are sold at rural markets. People's preferences are evolving as a result of the arrival of multinational companies selling pizza and burgers throughout the nation.

Over the past few years, India's bakery industry has grown at an annual pace of over 15%. There is tremendous room for expansion both domestically and internationally. Among the bakery products, bread has emerged as a vital ready-to-eat food item and is continually growing in popularity in hotels, canteens, and restaurants and in households.

Bread is a quick and convenient food made from wheat. With room for improvement, bread consumption is growing at an estimated pace of 135 percent. The production of bread in small towns and villages would not only satisfy local needs but also provide job opportunities nearby. These rise in consumption have also increased the varieties of bread, such as, brown bread, wheat bread, fortified bread, etc.

Only 1. 5 to 1. 75 kg of bread are consumed per person annually in India, depending on the zone. 27%, 32%, 23% and 18% are the consumption patterns of Northern state, Southern state, western and eastern state respectively. In the market for branded bread, Hindustan Unilever Ltd. (HUL) has overtaken Britannia Industries Ltd. as the dominant player (HUL).

Around 90% of the market for branded bread is accounted for by these two businesses, which serve the high- and medium-priced categories. Local businesses with a wide variety of local brands often target the mass market and make a significant contribution to the bread sector.

Significantly more small bread bakers still produce baked goods using conventional techniques. These local producers make quality compromises with their products in order to reduce production costs. Therefore, the majority of bakery goods are included on the lower end of the economy sector.

After China and the United States, India is the third-largest manufacturer of biscuits. Some of the major variables that influence the Indian biscuit market are rising purchasing power, a trend toward premium biscuits, the establishment of additional production facilities, rising health consciousness, innovative biscuit design, appealing packaging, etc.

The Indian biscuit market is now valued at 3. 9 billion USD and is predicted to reach 7. 25 billion USD by 2022, with a CAGR of 11. 27%. India is also one of the world's top biscuit-consuming nations.

surveys and industry estimates occasionally show that, as far as consumption patterns are concerned, the average consumption scenario in four zones are 28%, 24%, 25% and 23% in the northern zone, southern zone, western zone and eastern zone respectively. India consumes just about 2. 1 kg of cookies per capita, compared to more than 10 kg in the US, UK, and Western European nations.

Flatbread which is known as chapatti, roti, phulka,etc in India is an essential wheat product. Without this traditional flatbread, no Indian cuisine is complete. Not only in India, nowadays wheat flour has spread to western countries where its popularity is increasing due to its versatility.

Other than chapatti/roti, wheat flour is used to make tortilla, pizza,etc. A successful agricultural enterprise that has no seasonal restrictions is the flour milling industry, often known as aata chakki.

It is one of the most fundamental and important activities, especially in a nation like India where we regularly consume Rotis, Chapatis, and Parathas prepared from wheat flour. And not only this, flour is employed in preparing other cuisines and snacks also. As a result, running an aata chakki business is profitable.

Wheat processing can be India’s response to the current PM’s call for doubling farmers’ income. This vital industry connects farming, manufacturing, and end users; it decreases post-harvest waste via infrastructure development and significantly increases the value of agricultural products through processing technology. When the value created via the prevention of wastage travels back to the farmers through the value chain, it can greatly increase their income.

In the past, attempts have been made to boost farmers' income by raising food output, developing fresh methods for productivity improvement, offering incentives through improved crop prices and subsidies, as well as through public investment in agriculture and supporting agricultural institutions. Since independence, these efforts have boosted our agricultural output by 3.7 times, but this has not resulted in a proportionate rise in farmers' income.

The majority of farmers have yet to experience a notable increase in their income. These farmers continue to suffer losses as a result of a number of factors, such as a lack of post-harvest storage, transportation, and processing facilities, since they are at the lowest point in the value chain and therefore have little leverage in negotiations.

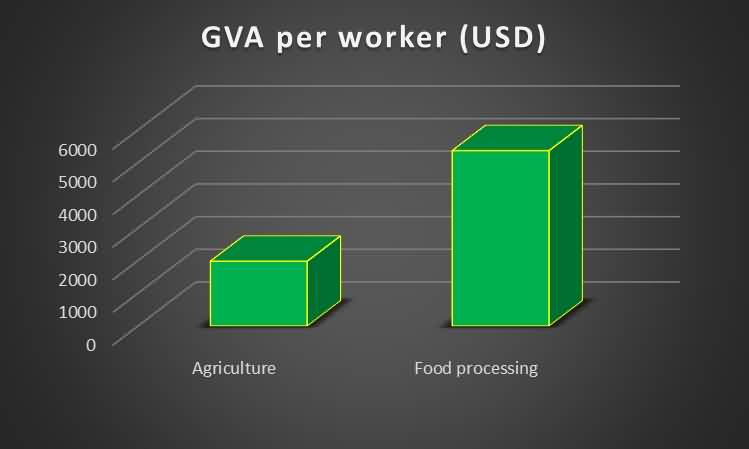

Globally, all major countries have developed food processing ecosystems with high levels of processing (70–80% compared to 10% in India)3 and proportionally higher value added per worker in agriculture. Despite being the leader in the production of a number of agricultural products, India is behind other nations in terms of the value added per agricultural worker. In order to add value to agriculture through food processing, the nation must act quickly.

In 2019, India's food processing industry produced substantially more gross value added (GVA) per worker (USD5,367 at current prices) than did agriculture (USD1,981)5. If given among the participants in the value chain, such as farmers, this higher GVA per worker might represent their potential profits.

To achieve this, it will be necessary to incorporate small and marginal farmers into the value chain of food processing, but not as producers, but rather as entrepreneurs engaged in primary and secondary processing operations that are profitable.

The following are just a few ways that food processing contributes to farmer’s income in addition:

Reducing post-harvest losses through effective transportation and storage:

Approximately 40% of all food is lost after harvest or while it is in transit in India, compared to just 28% worldwide, and this causes a major decline in farmer's income. Farmers may lower these losses by preserving food for longer periods of time with the use of well-developed storage and transportation facilities. Additionally, it permits agricultural profit at higher crop prices. The storage and transportation facilities must be available and reasonably priced to get the required results.

Processing near farm:

By processing low-value crops in primary and secondary ways to produce higher-value goods, farmers can add value to their harvests and boost household income. . A lot of farmers can benefit greatly from near-farm processing activities by adding more farms and broadening the product selection. Under its Scheme for Agro-Marine Processing and Development of Agro-Processing Clusters, the Government of India has sanctioned more than 63 near farm agri-processing clusters.

Linkages for Value chain:

Farmers can sell their processed product directly to large manufacturers or can be connected to food manufacturers through secondary/tertiary processors. The food processing market potential will likely generate greater demand for agricultural products, establishing a new market for processable varieties for farmers.

Food processing firms can engage in end-to-end arrangements for direct interaction with farmers which will include enhancement of farmer’s knowledge on cultivation of processable crops, production of higher value added crops, new technologies, mobile applications, online market, etc.

There are certain examples which show the collaboration of farmers with large companies that increased the income of farmers and quality of the product as well. Syngenta is one such inspiration that is collaborating with Italian farmers to improve both the quality and quantity of durum wheat production through a project known as Grano Armando.

The foundation of Grano Armando is Syngenta's creation of an advantageous network throughout the pasta supply chain, linking remote and frequently individual farmers with seed suppliers and pasta makers, including the company's own flagship brand, Grano Armando. Farmers are able to get the most out of their harvest and generate a steady income in a sustainable manner.

This cooperative partnership is encouraging the development of more acceptable and profitable products. One of the epitome which became an immense pride to farmers is Mc Vitie’s back to farm scheme. In order to resurrect the supply of group 3 wheat, often known as biscuit wheat, which had fallen out of favor with producers, the back to farm programme was introduced in 2015.

Currently, more than 216 farms in East Anglia and Northumberland provide 40% of the wheat that pladis, UK & Ireland needs to provide its biscuits. The business has expanded the programme to include a new set of farmers in the South of England and hopes to boost this amount by about 70% by the end of 2019. To get the 270,000 tonnes of wheat flour it needs yearly directly from farmers and grain cooperatives, the corporation basically broke from tradition of only purchasing via flour millers.

According to Pladis, this scheme not only enhanced its key supply relationships but also benefited farmers. Farmers feel proud to know that they are supplying one of Britain's most recognizable household brands.

Farmers can also enhance their income through the farmer's producers company. In terms of types of organization, membership, and numbers, producer organizations have had a good increase in India. The Producer Company is a unique instance of a producer organization that is registered under Section IXA of the Companies Act of 1956.

An autonomous farmers' organization was considered necessary at the time in order to enable the inclusion of producers into organizations like the firms that will be under their control, having a welfare and business orientation at the same time without compromising sustainability considerations. This sets up the environment for Farmers' Producer Company (FPC) to emerge in India.

Keeping this in view, PM Formalization of Micro Food Processing Enterprises Scheme proposed a project on milk bread processing which gives an idea to the farmers/ FPOs/ cooperatives to start up a new enterprise. The most reasonably priced ready-to-eat snack or meal offered in the Indian market is milk bread.

All socioeconomic classes have consumed it. Following globalization, there has been a significant shift in Indians' eating preferences, and as a result, bread is now considered a secondary staple meal in India, behind chapati and rice. When young children's diets are confined to low protein diets, milk bread helps to boost their growth and prevent deficiencies.

The milk solids in milk bread provide the critical amino acids that whole wheat bread lacks. Since Milk Bread has more nutritional content than other bread kinds, it is obvious that consumption of Milk Bread has grown throughout time. Over the projection period, baked goods are anticipated to expand by constant value at a two percent compound annual growth rate (CAGR).

Over the past few years, India's bread business has grown at an average yearly pace of over 15%. The issues that arise as a result of the business and industry's success are likewise escalating quickly. Similarly, through government programmes like the PMFormalization of Micro Food Processing Enterprises Scheme of MoFPI, Government of India, processing of pasta in particular provides enormous potential for entrepreneurial growth at the micro- or small-scale level.

An important programme for formalizing and mainstreaming unorganized home-based or micro food processing facilities is the Central Sector Scheme for Formalization of Micro Enterprises in the Food Processing Sector under the Ministry of Food Processing Industries. The plan is helpful for increasing the capacity and technological capabilities of the current units through the installation of new equipment and extra civil infrastructures.

The next sections go into great depth on the model Pasta Processing Detailed Project Report that was created using certain generic assumptions. This sample Detailed Project Report template may be modified by an entrepreneur to suit his or her needs in terms of capacity, location, raw material accessibility, etc.

In addition to the income generated through farming, processing wheat into various products has the potential to double farmers income in India by adding enormous value to the agricultural produce.

This can be easily achieved by providing better storage and transportation facilities, establishing market connections and involving farmers in processing activities.

Authors:

Satish Kumar*, Rajitha Nair, CN Mishra, Gyanendra Singh and GP Singh

ICAR-Indian Institute of Wheat and Barley Research Karnal-132001

Email: